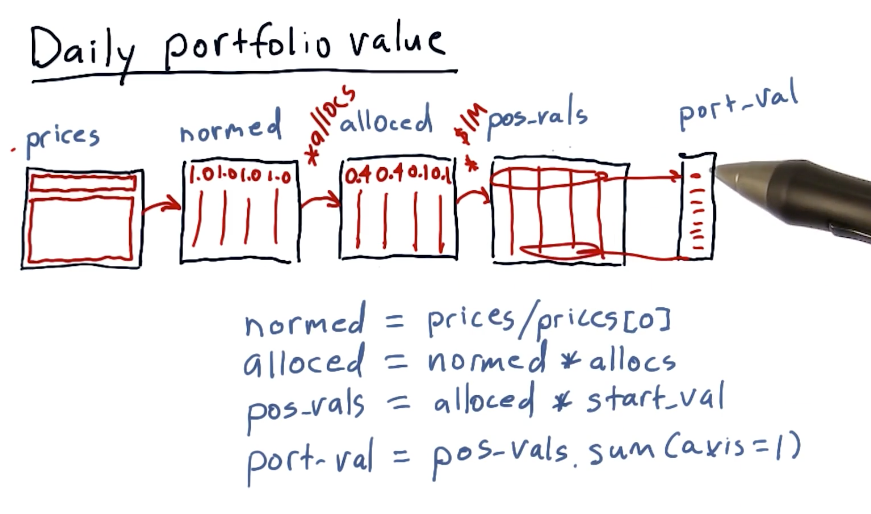

# Daily Portfolio Values

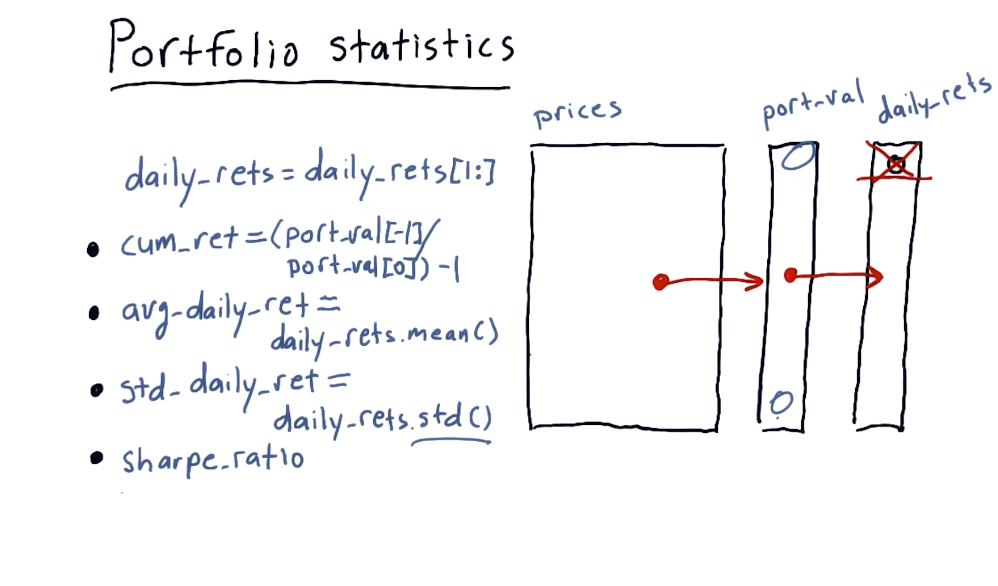

# Key Portfolio Stats

- Cumulative Returns: How much the value of portfolio has gone from beginning to end. (First row vs last row of Daily Portfolio Values)

- Average daily return: Average of the daily returns

- STD daily return / Risk: STD of the daily returns

- Sharpe Ratio: Risk adjusted return

# Sharpe Ratio

Risk adjusted return. Considers rewards in the light of risk.

- Lower risk is better

- Higher return is better

Where, E is expected (can be replaced with mean), Rp is Daily portfolio returns and Rf is Daily risk free returns

Rf in the denominator is normally zero since that is usually fixed.

# Risk Free Returns

Risk free returns usually comes from

- just inserting 0%

- Treasury bills or fixed deposit, etc

You have to convert the six month/yearly return to daily return in cases of fixed deposit.

A simple trick to convert, say a yearly fixed deposit return percent, to a daily return value

# Adjustment

- SR is an annual measure

- SR can vary widely depending on how frequently you sample

- SR annualized = K * SR

- K = square root of number of samples per year i.e. 252 for daily, 52 for weekly

# BPS - Basis points

1 bps = 0.0001 10 bps = 0.001 10000 bps = 1