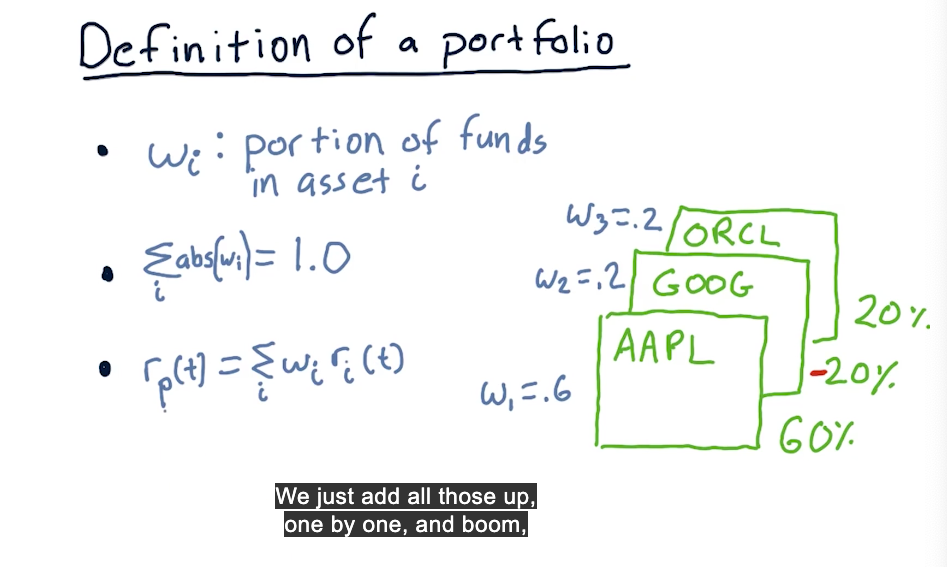

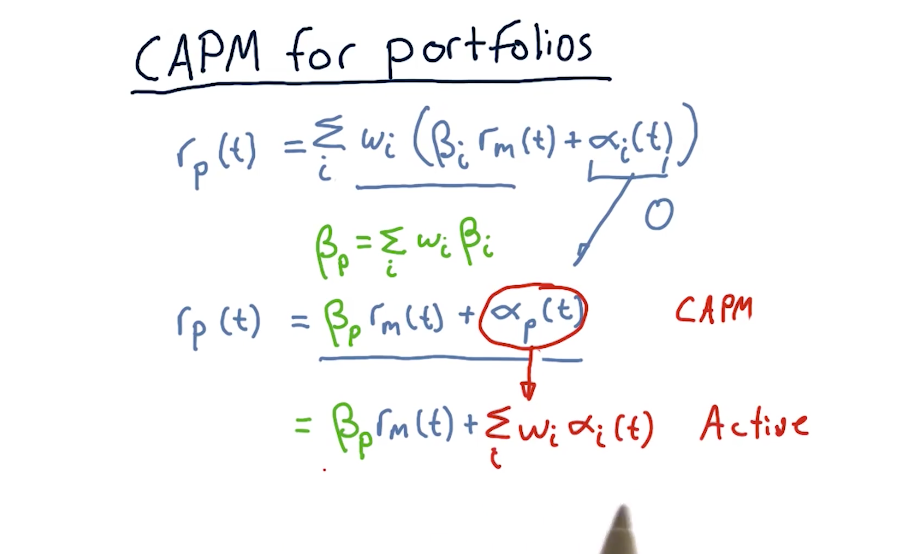

# Portfolio Definition

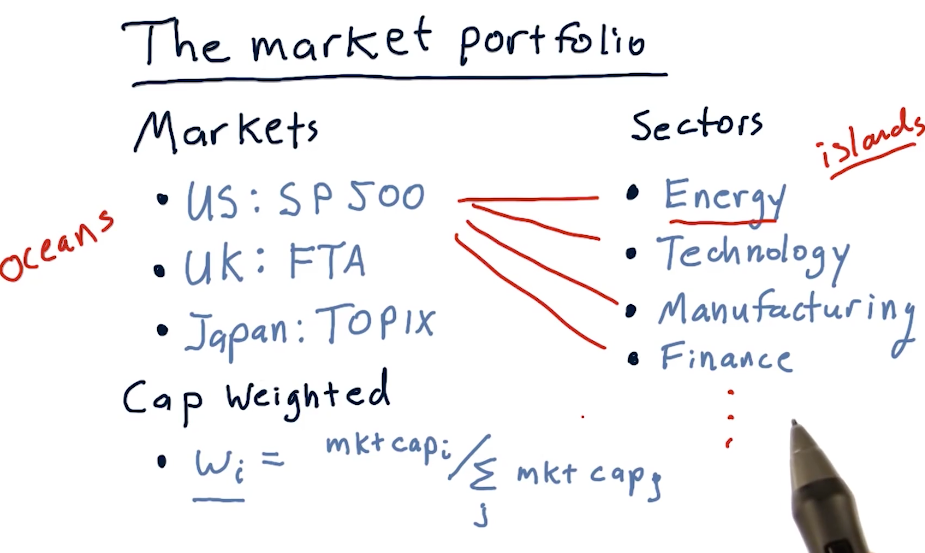

# Market Portfolio

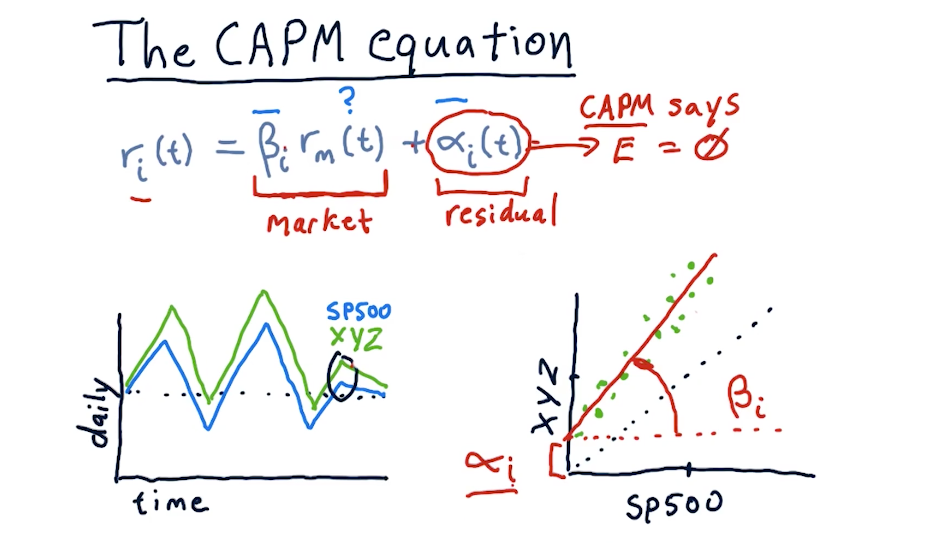

# CAPM Equation

Where,

is return for a stock ion a particular daybetais the effect of market on the respective stock change.is the return of the stock market alphais the residual effect on the respective stock change. Expectation for alpha is zero

Beta and alpha comes from daily returns by comparing the market return like SPY and stock return, and observing the relationship.

CAPM and active managers differ on their opinions of alpha. CAPM says alpha is random and expected value is zero, active managers believe they can predict alpha.

In upward market, we want a higher/positive beta, and in downward market, we want a lower/negative beta for a stock.

# Efficient Market Hypothesis

EMH assumes

- Large number of investors

- New information arrives randomly

- Prices adjust quickly

- Prices reflect all available infomration

Information comes from:

price/volume, fundamental, exogenous, company insiders

Three forms of EMH:

- Weak: future prices cannot be predicted by analyzing historical prices

- Semi-strong: prices adjust accordingly to new public info

- Strong: prices reflect all information public and private

There is evidence that future prices can be predicted to some extent and there is money to be made in the stock market. So, the EMH is not universally correct.

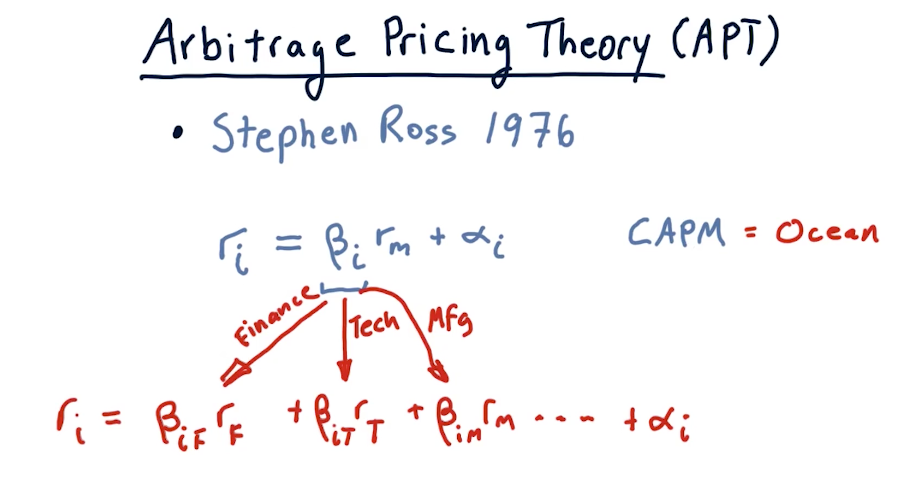

# Arbitrage Pricing Theory (APT)

Breaks up the beta component in CAPM to account for influences due to market sector

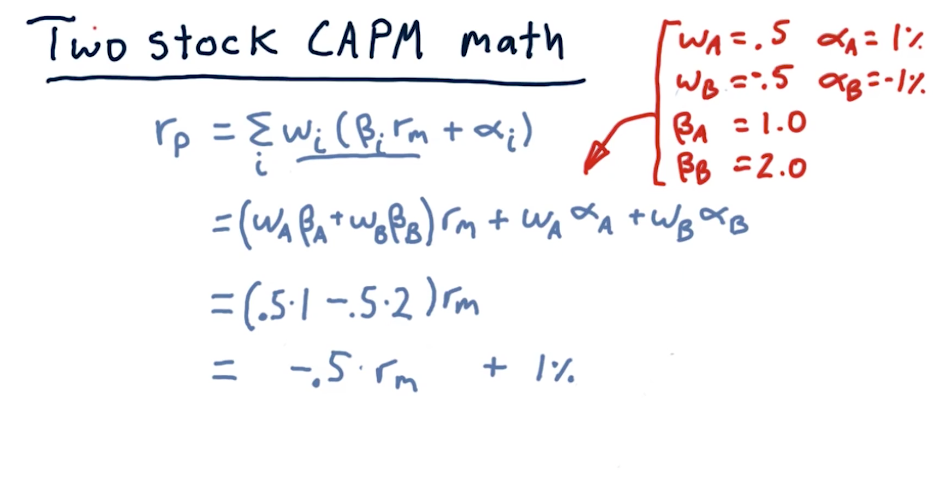

# Two stocks CPM path